From the 27th of February 2026, Cooksleys Sales & Lettings has been sold to

Blog

- Details

- Hits: 1142

Take a look at the recent Rental Price Tracker ?

You may find it of interest ?

- Details

- Hits: 1568

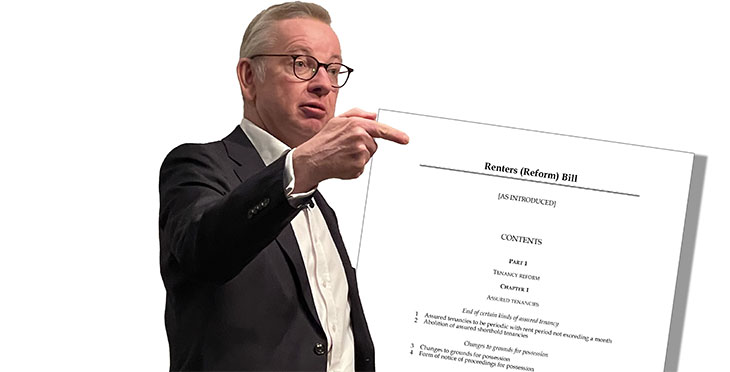

We are sure lots of you have seen the news recently so thought we would give you a progress report ..

NEWSFLASH! Renters' Reform Bill has been published by Government

- Details

- Hits: 1634

Cooksleys Letting Agent Service and Care

Cooksleys Estate Agents are one of the original independent estate agents in Exeter. Our well established office in South Street, has been valuing, selling and letting property in Exeter and the surrounding area for over thirty years.

Some letting Agents see their role as just solely as a tenant finder and to negotiate attractive terms for the Landlord .

But we have moved on as the industry has and as this is still a very important role .

Landlords are looking for more forward thinking and a more progressive view from their agent . The rental market can be volatile and an emotional journey for all involved . This is someone's Investment and another ones well-loved future home .

We strive to do our best to provide a full service or bespoke if wished . We have many important parts to the service we provide from start during and end . We carry out important regular property Inspections followed by a detailed report including advisories where needed and that all is well for the owner and the tenant likewise.

If the management is effective then as a rule all runs smoothly and well . Looking after our landlord is paramount as they are our clients but the tenant is very much an important part of a happy duration of tenancy also .

We offer a hands on approach to vetting and the reference procedure and is a vital service and ensure commitment to securing the best tenant .

Let us help make your Investment enjoyable rather than endurable . We are an Agent who believes in a supportive service that is personal and provides full commitment .

Kindly feel free to contact us and happy to advice for a non-obligation chat as we are here to help . # https://buff.ly/3al6dSk ☎️ #https://www.cooksleys.co.uk/about-us

- Details

- Hits: 2377

Exeter Rental market summary from Home.co.uk

Exeter Market Rent Summary

Our rental price analysis for Exeter summarises the advertised rents for homes to let, calculated daily from the rental properties found by the Home.co.uk Property Search Engine

Summary of Properties for Rent in Exeter

Total properties for rent in Exeter: 328

Properties for rent in Exeter listed in the last 14 days: 88

Average* property rents in Exeter: £2,035 pcm

Median* rent: £1,500 pcm

Properties for Rent in Exeter by Price

No. of properties -

Rent under £250 pcm 1

£250 to £500 pcm rent 3

£500 to £1,000 pcm rent 90

£1,000 to £2,000 pcm rent 113

£2,000 to £5,000 pcm rent 109

Rent over £5,000 pcm 12

Property Rents in Exeter by Number of Bedrooms

No. of properties

Average rent Median rent

One bedroom 48 £790 pcm £785 pcm

Two bedrooms 76 £1,339 pcm £1,113 pcm

Three bedrooms 72 £1,698 pcm £1,425 pcm

Four bedrooms 37 £2,313 pcm £2,400 pcm

Five bedrooms 25 £3,048 pcm £3,142 pcm

Property Rents in Exeter by Type

No. of properties Average rent Median rent

Room 18 £1,631 pcm £812 pcm

Flat 94 £1,396 pcm £1,000 pcm

House 203 £2,405 pcm £2,000 pcm

Note: The current rents for Exeter were calculated by sampling over all properties for rent in the Home.co.uk property search within 5 miles of the centre of Exeter

- Details

- Hits: 1625

We at Cooksleys lettings are proud to donate to such a vital and much needed organisation and charity